Housing is one of the rights of the UN’s Universal Declaration of Human Rights, amongst other legal instruments, that’s overlooked far more often than it should be. The housing market in the UK remains ever more broken, and a source of many of society’s ills.

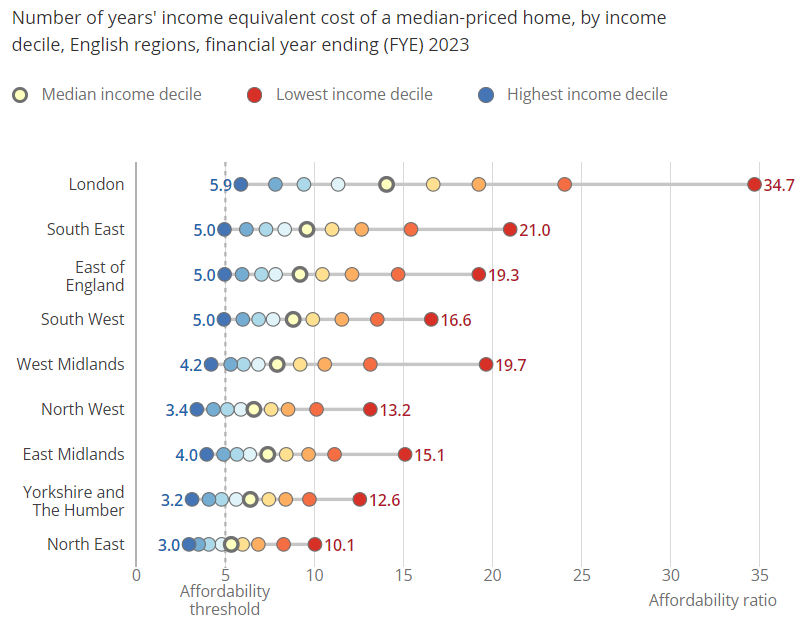

Last week the Office of National Statistics released a report that showed that in 2023 only the 10% richest households by income could afford to buy an averagely-priced house in England. The situation is a little better in Wales (top 30%) and Scotland (top 40%). Not even the top 10% richest households in the area could really afford a house in London.

The definition of affordability that they use is that a house is considered affordable if it costs no more than 5 times the annual income of the household concerned.

Across England, the average annual disposable household income was £35,000. That’s the income people get per year after direct taxes have been deducted. Whereas the average house price was £298,000, representing nearly 9x average annual income. The average house in London sold for £530,000 in the same time period.

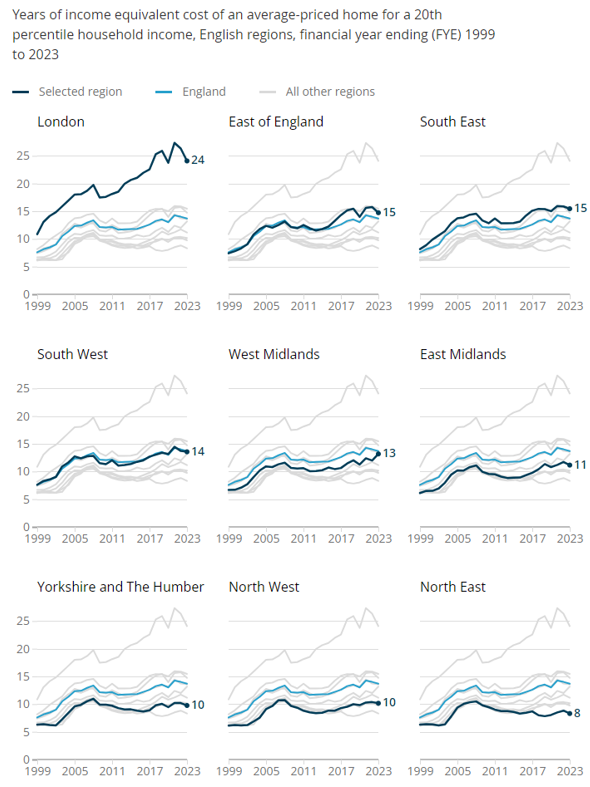

In England, house prices have been increasing twice as fast as incomes since they started measuring this around 1999. The change for London over time when measured like this is particularly shocking.