Mortgage payments look to be one of the next crises the UK is going to have to stare into the existential void of, or do something about.

Not content with folk being unable to afford food to eat or energy to heat, it seems like housing may be the next to go. Even for those people who are rich or lucky enough to be mortgaged home owners - in many places it’s been nearly impossible for first time buyers to get onto the housing ladder in the first place.

As the British economy appears to destroy itself in reaction to the Conservative’s recent bewildering and reckless mini-budget, the Bank of England has felt compelled to raise interest rates. This has many consequences, but of note here is the fact that many mortgages are directly linked to the BoE interest rate. Those that aren’t are likely influenced by it, at least at the time of taking out the loan.

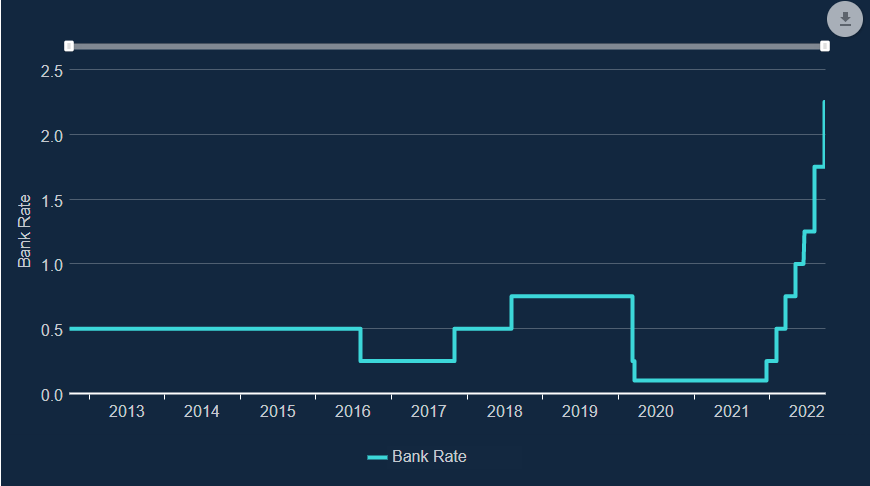

The Bank of England’s web page shows how the interest rate has changed over the past decade.

So it’s been very low, under than 1% for most of the decade, but has already shot up to more than double that figure recently. But that’s not where it’s likely to stop. The markets are apparently pricing in an expected rate of 6% for next year.

This certainly isn’t historically unprecedented - the rate was last 6% back in 1999, and it was more than double that a decade before. But people have obviously been taking out mortgages - and companies have been offering them - based on the situation in contemporary times rather than the state of the world 20 years ago. Even if a consumer did proactively try and integrate future interest rate considerations into their mortgage decision they wouldn’t have been saved; just a few months ago the projected interest rate for next year was just a quarter of what it seems like it may turn out to be.

There are about 2.2 million people on variable rate mortgages, who are likely to be affected in the short term. About 3 times as many people currently hold fixed rate mortgages so are “safe” in the short term, but as soon as they come to the end of their fixed rate - usually 2 or 5 years after they took the mortgage out - they will end up in the same disaster-laden boat.

The consequential differences in the monthly payments homeowners will be required to make are not small! Unfortunately a rise of 1 percentage point in the bank rate doesn’t mean your payments get 1% larger. For mortgages that follow the Bank of England rate, the interest rate relates to that of your debt. I’m sure many of us have been schooled about the miracle of compound interest when it comes to savings. Unfortunately the same applies to debt.

Various articles have given some example calculations. A tweet from economist Samuel Tombs calculated that the average household looking to refinance a 2 year fix next year would need to find £627 extra a month.

If mortgage rates rise to 6%—as implied by markets’ current expectations for Bank Rate—the average household refinancing a 2yr fixed rate mortgage in the first half of 2023 will see *monthly* repayments jump to £1,490, from £863. Many simply won’t be able to afford this (1/2) pic.twitter.com/hkoZCcSfjJ

— Samuel Tombs (@samueltombs) September 26, 2022

Others examples quoted by Yahoo Finance include someone with a £140k mortgage that went from 2.25% to 6% would need to pay an additional £270 a month.

You can choose your own example using one of the many mortgage calculators, such as the one from MoneySavingExpert.

With that for example you can see that you’d taken out £150k over 25 years at say 1.5%, that’s a monthly payment of £600. The same borrowing at next year’s expected interest rate of 6% would cost you £967 a month.

In the mean time, the state of affairs is in such disarray that 985 mortgage products were withdrawn from sale overnight, with some banks and building societies entirely stopping offering mortgages to new customers.